Bayesian model to infer private equity returns from capital in and outflows

Learn how PyMC Labs and Everysk collaborated to develop a Bayesian model that provides insights into private equity returns from capital in and outflows, and how this model differs from standard machine learning analyses.

Business challenge

Everysk is the leading provider of risk workflows for multi-asset, global portfolios with portfolios that span many different asset classes. A key part of any financial risk assessment is understanding the time varying value added factors and exposure of the investment, as well as having an index against which to compare performance.

In liquid markets indices can be readily calculated from public and relatively frequent transactions, allowing for comparison, risk assessment, and benchmarking of portfolios. Private Equity lacks similar transaction-based performance measures; estimating them is not a straightforward process, and requires some statistical estimation. So how can we figure out the unknown from the things we know? The answer lies with Bayesian Statistics.

Modern day Bayesian statistics is a combination of statistical expertise, business knowledge, and computing. By combining the strengths and using a principled approach, organizations are able to gain deeper insights than previously possible. The multifaceted nature of this challenge was a perfect match for a partnership between PyMC Labs and Everysk, as Everysk had the data and business expertise, and PyMC Labs lent the statistics and computational expertise.

From understanding to implementation to extension

PyMC Labs and Everysk set up an initial client meeting to jointly scope out the problem from a technical and business perspective. Everysk and PyMC Labs reviewed existing code together, briefly talked through the paper. Everysk wanted to implement, as well as what Everysk was looking to do with the model. From these conversations, the joint team was able to align on key latent (i.e hidden), factors of interest, and the “checkpoints” to ensure the analysis was on the right track.

With understanding of the task and solution, PyMC Labs spent the first week exploring the data, understanding the details of the paper, and building an initial model. This initial model served as a testing ground, to ensure that modeling the hidden factors of interest was possible, that the results were sane, and that there was value for Everysk. Because the PyMC Labs developers are also the maintainers of PyMC, they were able to incorporate numerous improvements to the original paper that led to a faster and more accurate model. For example the original paper used first generation samplers, which were quite slow, while PyMC Labs upgraded the samplers to speed up the run time of the model, leading to faster iteration cycles.

In particular, this approach was needed by Everysk, as it wasn’t seeking predictions but rather seeking understanding of why the trend line was behaving a certain way. This insight would not have been available from a standard machine learning analysis.

With Everysk, PyMC Labs worked hand-in-hand to interpret the results, fix any outstanding issues, and run experiments. By having the team available for questions, Everysk was able to become more comfortable with the results.

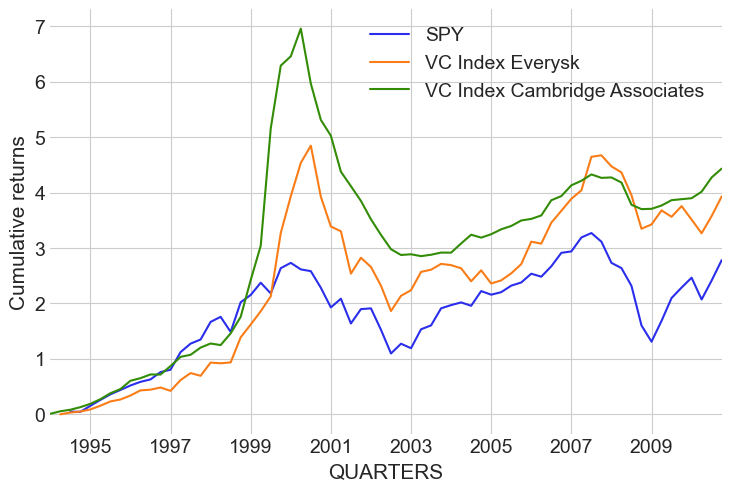

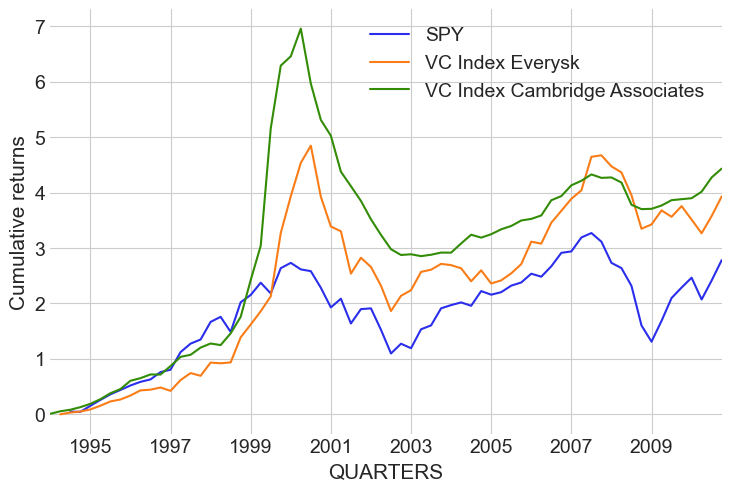

Cumulative private equity returns. Released with client permission.

This plot shows the cumulative returns of the US stock market (blue), the private equity venture capital (VC) index that was produced by the Bayesian model (orange), as well as the VC Index produced by Cambridge Associates for comparison (green).

Work with PyMC Labs

If you are interested in seeing what we at PyMC Labs can do for you, then please email info@pymc-labs.com. We work with companies at a variety of scales and with varying levels of existing modeling capacity. We also run corporate workshop training events and can provide sessions ranging from introduction to Bayes to more advanced topics.